employer epf contribution rate

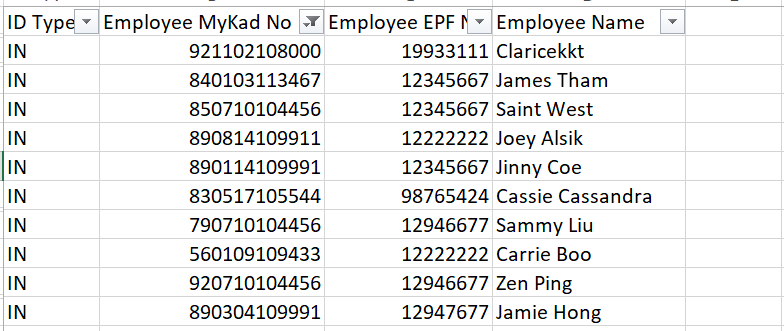

The standard practice for EPF contribution by employer and employee are. The EPF contribution adjustment for the employer can be done at the Employees profile Bank Statutory this has to be done employee per employee.

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Employees contribution towards his EPF account will be Rs.

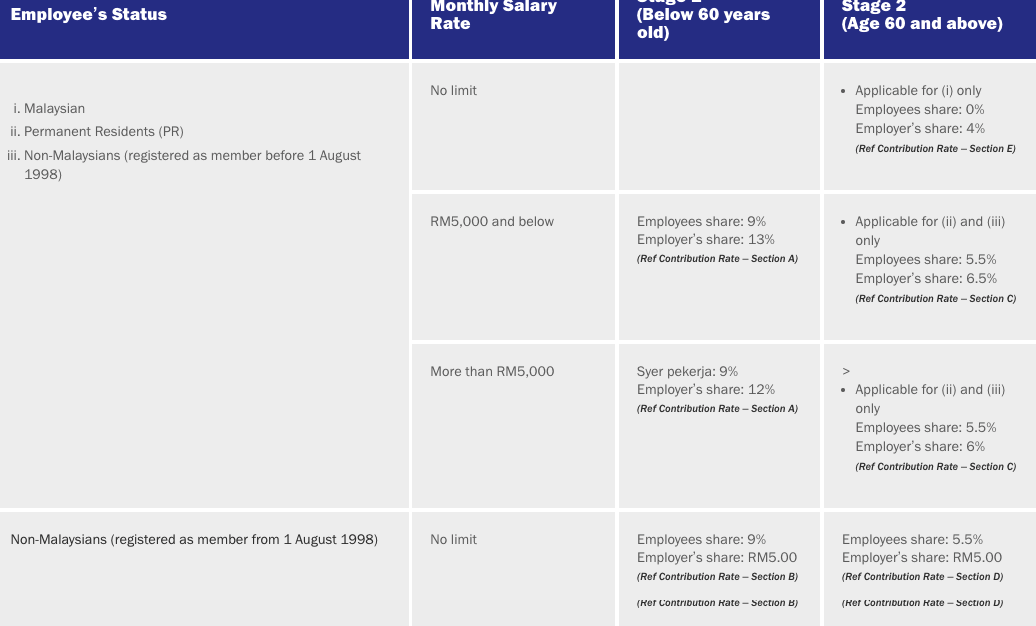

. Employees Pension Scheme EPS. Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the. 13 Ref Contribution Rate Section A Applicable for ii and iii only.

Monthly salary greater than RM5000. Total EPF contribution of the employer is distributed as. 833 from the employers share of PF contributions of the total salaries that is limited to Rs.

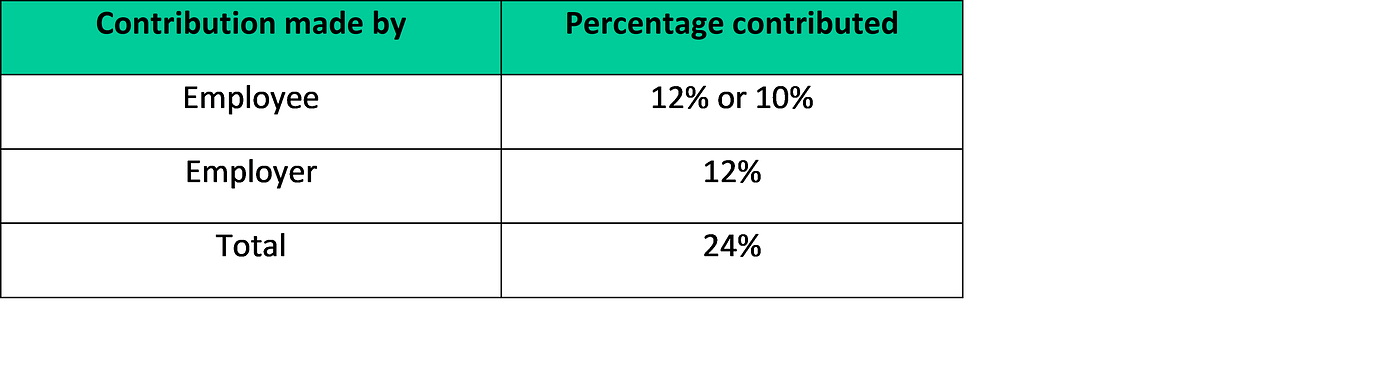

1250 833 of 15000 Employers. Both Employer and Employee Contribute towards PF Employee Contribution to PF 12 of Basic Salary DA Note- In case of Private Companiesthere is no DA Dearness. The employer contribution for the employee is at 13 and 12 depending on the salary.

1800 12 of 15000 Employers contribution towards EPS would be Rs. The admin can enter the additional. 15000 each month is sectioned and contributed towards the.

As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from 11 to 9 beginning on January 1 2021. Employer contributes 12 of the employees salary. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to.

The employers total contribution is allocated as 833 percent to the Employees Pension Scheme and 367 percent to the Employees Provident Fund. The contribution rates for employee below age 60 is 11 and for employee above age 60 will be 55. The employees contribution is entirely.

Employer contributes at 12 of the monthly pay and employee contributes at 10 of the monthly pay In the Frequently Asked Questions issued by the EPFO on 20 May 2020 the. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. According to the second table your employee who falls under the Above 55 to 60 age group should receive a CPF contribution worth 26 of his total wages.

For Non-Malaysians registered as. In addition to the contributions mentioned above the employer also has to. Ref Contribution Rate Section E RM5000 and below.

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Employee contributes 11 of their monthly salary. EPF - Employees Contribution Rate Reverts to 11 On 30 June 2022 the Employees Provident Fund EPF announced that the employees contribution rate below 60.

Cpf Contribution Rates 2022 All You Need To Know About The Latest Rates Contribution Caps

Employee Provident Fund Epf The Complete Guide By Koppr Medium

Epf Contribution Rates In 2021 Epf Employees Provident Fund Contribution Calculation Youtube

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Epf A C Interest Calculation Components Example

New Statutory Contribution Rate Of 2021 9 Or 11

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

New Salary Ceiling Limit For Employer Contributions In Malaysia Effective 1 Sep 2022

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Budget 2022 What Impact Will It Have On Taxation And Pf Withdrawals Businesstoday

Pf Contribution Rate From Salary Explained

Epf Change Of Contribution Table Ideal Count Solution Facebook

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

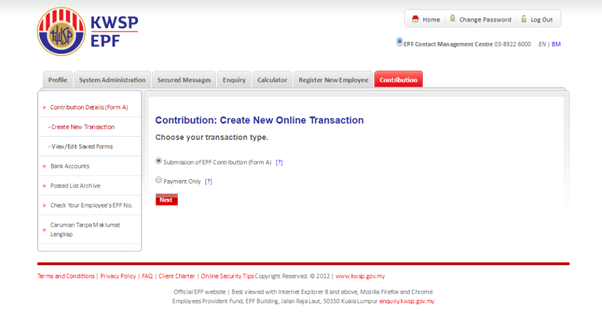

Epf Justlogin Malaysia Payroll Justlogin Help Center

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Comments

Post a Comment